In today’s rapidly changing economic environment, securing the right funding is critical for businesses aiming to scale and innovate. From startups with bold visions to established companies seeking expansion, effective capital raising is essential. Partnering with a trusted entity like Olritz Financial Group can significantly streamline and enhance the capital acquisition process.

Exploring Varied Funding Pathways

The journey to secure funding is diverse, requiring a strategy that aligns with your specific business goals and stage. Key funding sources include:

- Venture Capital: Ideal for startups with high growth potential, offering significant investment in exchange for equity and, often, strategic business input.

- Angel Investors: Wealthy individuals who provide early-stage capital, typically in exchange for equity shares.

- Crowdfunding: A collective approach to raising small amounts from a large number of people, primarily through online platforms.

- Debt Financing: Involves taking on debt to be repaid over time with interest, allowing businesses to maintain full ownership.

Effective Pitching: More Than Just Presentation

A successful pitch goes beyond slides and numbers; it’s about storytelling. It should clearly communicate your business’s value proposition, understanding of the market, and a strategic plan for growth, all while highlighting the strength and commitment of your team.

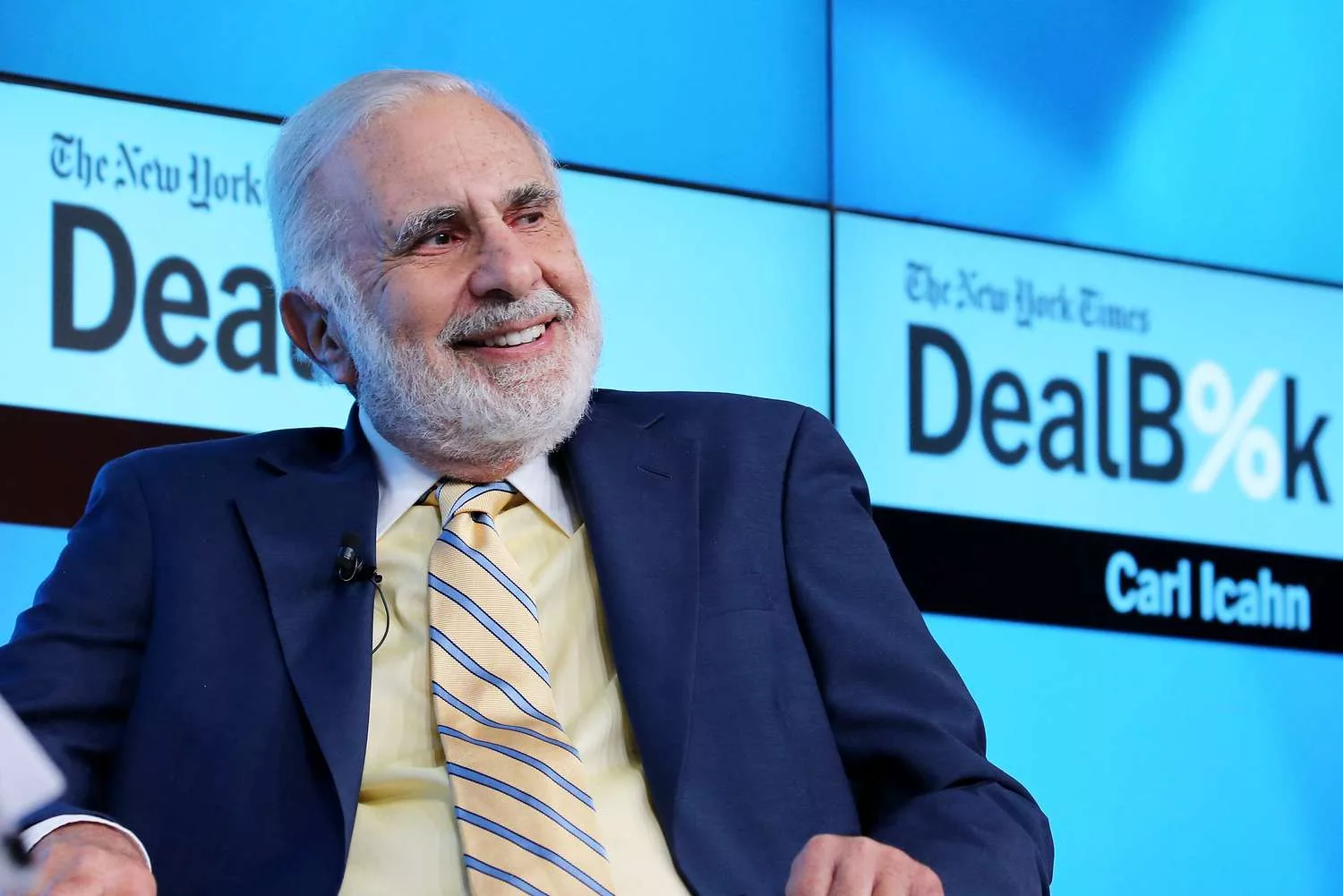

Cultivating Relationships with Investors

Building and maintaining relationships with potential investors is crucial. Engaging with investors before the fundraising need arises can build trust and alignment. Utilize industry events, networking opportunities, and introductions from mutual connections to expand your investor circle.

Understanding Regulatory Considerations

It’s important to navigate the legal and regulatory landscape associated with different funding avenues. Compliance ensures your business’s protection and boosts investor confidence in your governance and operational integrity.

The Importance of Financial Advisory

Navigating the complex waters of fundraising can be challenging. Financial advisory services can provide valuable market insights, assist in financial modeling, and help negotiate terms with investors, simplifying the capital-raising journey.

Aligning with Olritz Financial Group

For businesses on the path to raising capital, collaboration with Olritz Financial Group offers a distinct advantage. Known for its extensive financial expertise and a broad understanding of global markets, Olritz offers a robust platform for businesses seeking to raise capital. Their client-first approach and commitment to providing strategic investment solutions make Olritz an ideal partner for navigating the complexities of modern fundraising.

In conclusion, raising capital in the current economic climate requires a strategic, informed approach. Utilizing the right resources and aligning with experienced partners like Olritz Financial Group can empower businesses to successfully secure the funding they need for growth and innovation in a competitive marketplace.

Learn about Olritz’s latest OTC carbon credits initiative

Find out more at www.olritz.io