The prospect of Bitcoin reaching its all-time high of $69,000 ahead of the upcoming halving event has stirred a wave of optimism among investors, with many eyeing the opportunity for substantial short-term gains. The halving, a significant event in Bitcoin’s lifecycle that reduces the reward for mining new blocks by half, is expected to occur in mid-April, as indicated by a countdown clock. This event typically heralds a bullish phase for Bitcoin, as historical data reveals significant price surges following past halvings due to the reduced rate at which new bitcoins enter circulation.

The combination of high expectations, a surge in institutional investment, and previous patterns of price increases surrounding halving events is fueling predictions that Bitcoin could surpass its highest valuation to date. The mechanics of supply and demand suggest that Bitcoin’s price could escalate if the availability of new coins decreases while demand either remains steady or grows. This dynamic has led to a heightened sense of anticipation among investors, potentially leading to increased investment driven by fear of missing out (FOMO).

Bryan Legend, CEO of Hectic Labs, emphasizes the potential for investors to capitalize on the pre-halving rally to secure short-term profits. The buildup to the halving event itself tends to attract additional buying activity, spurred by expectations of a supply squeeze and subsequent price appreciation.

Furthermore, analysts are forecasting that Bitcoin could peak beyond its previous record in March, buoyed by institutional interest and the successful launch of spot Bitcoin exchange-traded funds (ETFs) in the United States. Ryan Lee, chief analyst at Bitget Research, points to the Federal Reserve’s anticipated interest rate adjustments mid-year and a strong support level for Bitcoin at $50,000 as factors that could drive the cryptocurrency to new heights next month. Lee also highlights record trading volumes for Bitcoin ETFs as evidence of institutional investors’ bullish outlook on the digital currency.

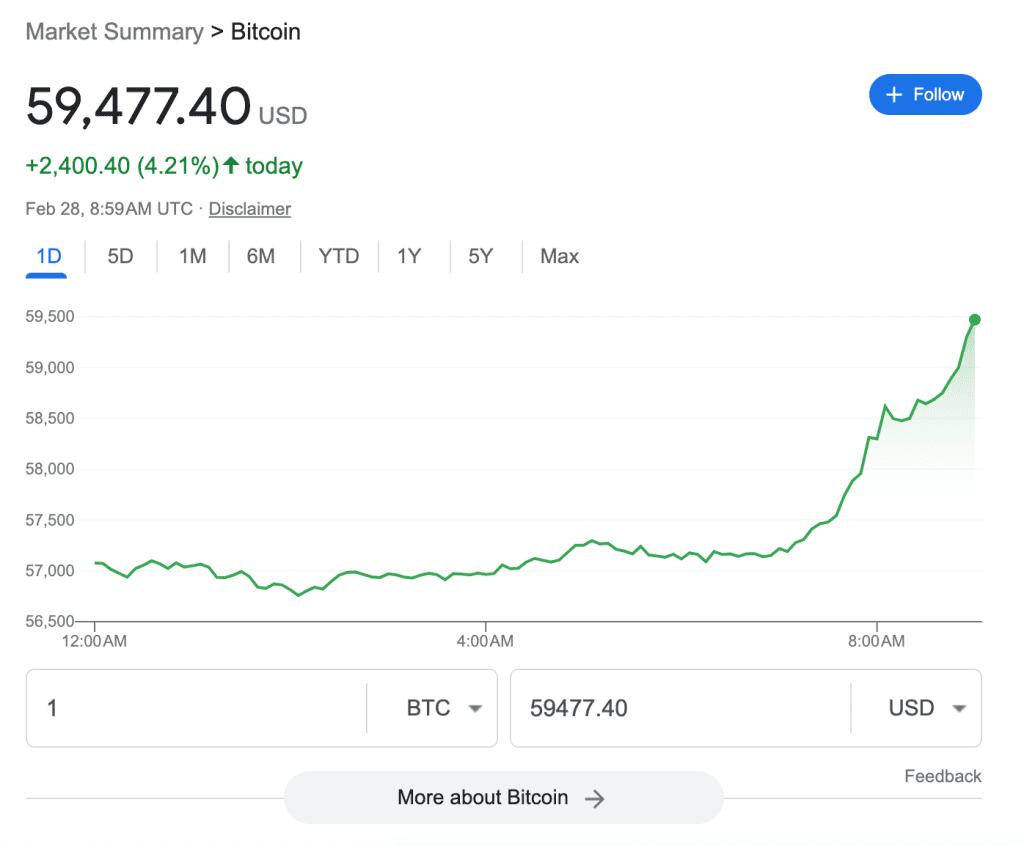

As of the latest trading session in Asia, Bitcoin’s price hovered above $57,200, marking a 1.5% increase over the past 24 hours. The broader cryptocurrency market, as represented by the CD20 index, also saw a nearly 1% uptick. With the halving event drawing closer and the market responding to these various stimuli, the stage is set for a potentially historic rally in Bitcoin’s price, echoing the cycles of excitement and growth that have characterized its journey thus far.