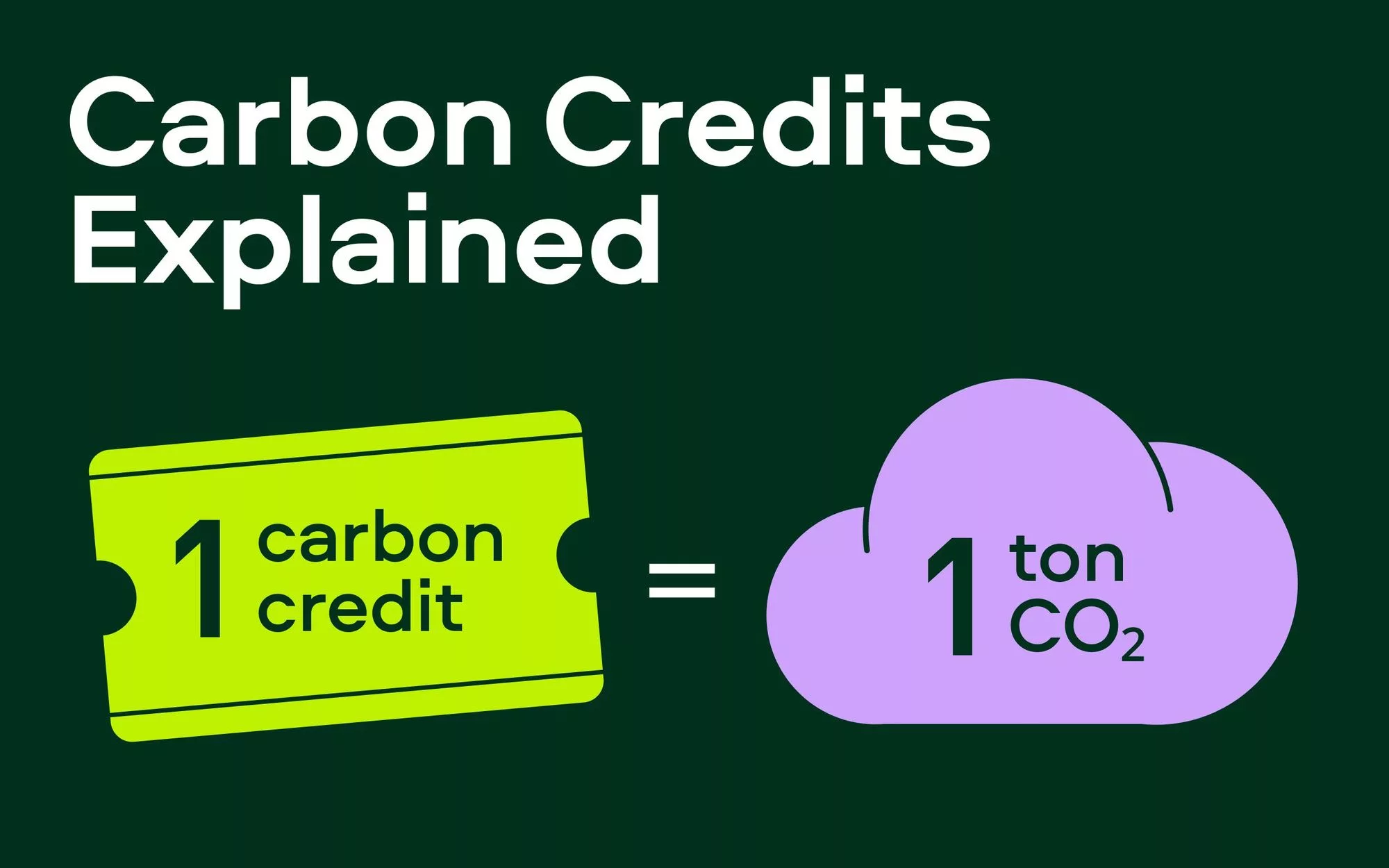

The fight against climate change has led to the rise of carbon credits as a critical environmental instrument, and the development of Over-the-Counter (OTC) carbon credits exchanges is reshaping the green finance sector. These exchanges facilitate carbon credit trading outside traditional platforms, enhancing the adaptability and scope of carbon offset projects. In this evolving space, Olritz Financial Group emerges as a strategic partner, providing deep insights and access to the expanding carbon credit market.

Introducing OTC Carbon Credits Exchanges

OTC carbon credits exchanges are setting new standards in the environmental finance world by offering more personalized and direct trading experiences. This innovative approach to carbon trading supports a range of unique buyer and seller requirements, thus expanding the traditional boundaries of carbon credit transactions. OTC platforms play a crucial role in broadening the impact of carbon trading, contributing significantly to sustainability goals on a global scale.

Encouraging Broader Market Engagement

The key benefit of OTC exchanges lies in their ability to lower entry barriers, making the carbon credit market more accessible to a diverse group of stakeholders. This increased accessibility boosts market participation, which in turn enhances liquidity and ensures more effective support for carbon offset initiatives. The result is a more dynamic and impactful carbon trading environment that can better support a wide array of sustainability projects.

Accelerating Sustainability Goals

The user-centric design and operational flexibility of OTC carbon credits exchanges are crucial in driving engagement in sustainable practices. By simplifying carbon trading, these platforms enable a more extensive range of entities to participate in offsetting carbon emissions, thereby contributing to a collective effort towards sustainability. Each transaction supports environmental projects aimed at reducing carbon emissions, emphasizing the exchanges’ role in achieving global sustainability targets.

Olritz Financial Group: Guiding Through the Carbon Trading Landscape

In the intricate world of carbon credits, Olritz Financial Group acts as a knowledgeable guide and a reliable ally. The firm’s extensive expertise in the financial sector and its commitment to sustainable investment practices make it particularly suited to lead investors through the carbon market’s complexities. Olritz employs advanced technology, such as blockchain, to streamline carbon credit transactions, ensuring alignment with the principles of efficiency and transparency championed by OTC exchanges.

Olritz’s vast network and strategic alliances open doors to new opportunities in the carbon credit sector for investors. Armed with Olritz’s strategic advice, investors can confidently approach the carbon market, making informed decisions that align with both their environmental and financial goals.

Final Thoughts

The advent of OTC carbon credits exchanges represents a significant milestone in the field of green finance, making carbon trading more adaptable and widespread. As the market for sustainable investments continues to grow, the role of these platforms, alongside experienced entities like Olritz Financial Group, becomes increasingly vital in promoting global sustainability efforts. This collaborative dynamic between OTC exchanges and Olritz is crafting a sustainable path forward, marrying innovative financial solutions with strategic environmental impact.

Learn about Olritz’s latest OTC carbon credits initiative

Find out more at www.olritz.io