On a remarkable Friday, Nvidia (NVDA.O) experienced a fleeting yet monumental surge in market valuation, touching the $2 trillion mark for the first time, propelled by an unyielding demand for its chips. This demand underscores Nvidia’s pivotal role in spearheading the generative artificial intelligence (AI) revolution that’s currently captivating Wall Street.

This significant achievement came on the heels of Nvidia announcing another impressive revenue forecast, which catapulted its market value by an unprecedented $277 billion in just one day. This surge set a new record for the largest single-day gain on Wall Street, highlighting the company’s meteoric rise within the past year.

Analysts have likened Nvidia’s role in the AI sphere to that of essential tool providers during the historic gold rush of the 1800s. Nvidia’s chips are integral to the operations of nearly all major players in the generative AI space, from ChatGPT’s parent company, OpenAI, to tech giant Google. This indispensable position enabled Nvidia to double its market value from $1 trillion to $2 trillion in a mere eight months, outpacing the growth trajectories of tech behemoths like Apple (AAPL.O) and Microsoft (MSFT.O).

Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, emphasized the boundless potential for AI companies, noting that their growth is not limited by demand but by their capacity to meet the surging needs of the market.

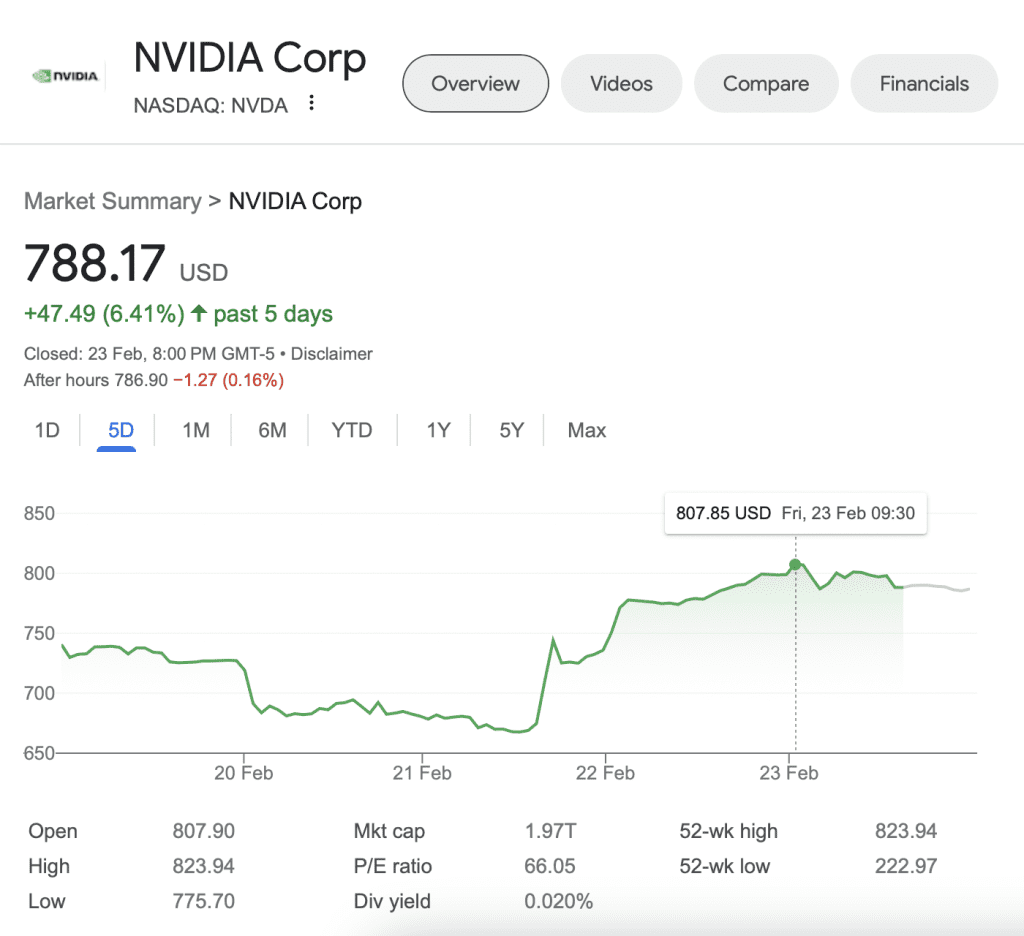

By the close of trading on Friday, Nvidia’s shares had risen by 0.4%, culminating in a market valuation of approximately $1.97 trillion. Earlier in the day, the shares had spiked by up to 4.9%, reaching an all-time high of $823.94, following a substantial 16% increase on Thursday.

Nvidia’s stock has seen an almost 60% increase this year alone, building on a more than threefold increase in 2023. This growth has been a significant contributor to the S&P 500’s (.SPX) performance, accounting for over a quarter of the index’s gains this year.

The company’s latest forecast, projecting a staggering 233% growth in first-quarter revenue, played a key role in driving global markets to new heights on Thursday.

The rapid expansion of Nvidia has attracted widespread attention from analysts and investors worldwide. A European fund manager remarked on the overwhelming response to Nvidia’s results, underscoring the heightened interest and engagement from the financial community.

Despite the remarkable surge in share value, Nvidia’s valuation metrics have seen a relative decline due to rapid adjustments in analysts’ forecasts. The company’s 12-month forward price-to-earnings ratio now stands at about 31, a decrease from 49 times a year ago, according to LSEG data.

Brian Colello, a strategist at Morningstar, highlighted the strategic investments by leading cloud computing firms to meet the growing demand for AI training and inference, with Nvidia poised to be the primary beneficiary of these expenditures.

As Nvidia continues to ramp up its chip supply, revenue projections for fiscal 2025 suggest significant quarterly increases, underscoring the company’s dominant position in the AI and tech industry. This expansion not only reaffirms Nvidia’s status as a key player in the technological revolution but also sets the stage for further growth and innovation in the global market.