In the dynamic investment ecosystem, private equity (PE) and venture capital (VC) stand out as two of the most promising avenues for investors looking to diversify their portfolios and tap into high-growth opportunities. As we delve deeper into what makes these investment strategies increasingly attractive, it’s essential to understand the unique value they bring to the table.

The Growth Engine of Private Equity

Private equity involves investing directly into companies, typically those not listed on public stock exchanges. This investment strategy is known for its potential to significantly influence the operational and strategic direction of a company, driving growth and efficiency improvements. For investors, the appeal lies in the potential for substantial returns, as PE firms work to increase the value of their portfolio companies through hands-on management and strategic initiatives.

Venture Capital: Fueling Innovation

Venture capital, a subset of private equity, focuses specifically on investing in startups and early-stage companies with high growth potential. VC firms are often drawn to innovative businesses with the potential to disrupt industries or create new markets. The allure of venture capital investing comes from the opportunity to be part of groundbreaking developments and the possibility of outsized returns if these startups succeed.

Leverage in Market Fluctuations

Both PE and VC investments offer a degree of insulation against market fluctuations. Since these investments are not directly tied to public market performance, they can provide stability in times of volatility. Moreover, the long-term investment horizon associated with PE and VC allows for strategic adjustments and pivots, making it possible to navigate through economic cycles more effectively.

Access to Emerging Markets

Private equity and venture capital are critical conduits to emerging markets and sectors. These investment vehicles often target industries poised for rapid expansion, such as technology, healthcare, and renewable energy. By investing in PE and VC, individuals gain exposure to these high-growth areas, potentially reaping the benefits of early entry into burgeoning markets.

The Role of Expertise

Investing in private equity and venture capital requires a nuanced understanding of industries, market dynamics, and company-specific challenges. This is where the expertise and network of a seasoned investment firm can be invaluable. By leveraging the knowledge and experience of experts, investors can mitigate risks and maximize the potential for substantial returns.

Partnering with Olritz Financial Group

In navigating the intricate world of private equity and venture capital, aligning with a knowledgeable and experienced partner like Olritz Financial Group can make all the difference. With its extensive expertise in asset management and a keen eye for cross-border financial opportunities, Olritz is well-positioned to guide investors through the complexities of PE and VC investments.

Under the leadership of Sean Chin MQ, Olritz Financial Group has demonstrated a consistent ability to deliver exceptional results, backed by a global network and a client-centric approach. For those looking to explore the promising avenues of private equity and venture capital, Olritz offers the strategic insights and tailored solutions necessary to thrive in this investment landscape.

As the investment world continues to evolve, private equity and venture capital emerge as key players in shaping the future of finance. With the right approach and a trusted partner like Olritz Financial Group, investors can unlock the full potential of these dynamic investment strategies.

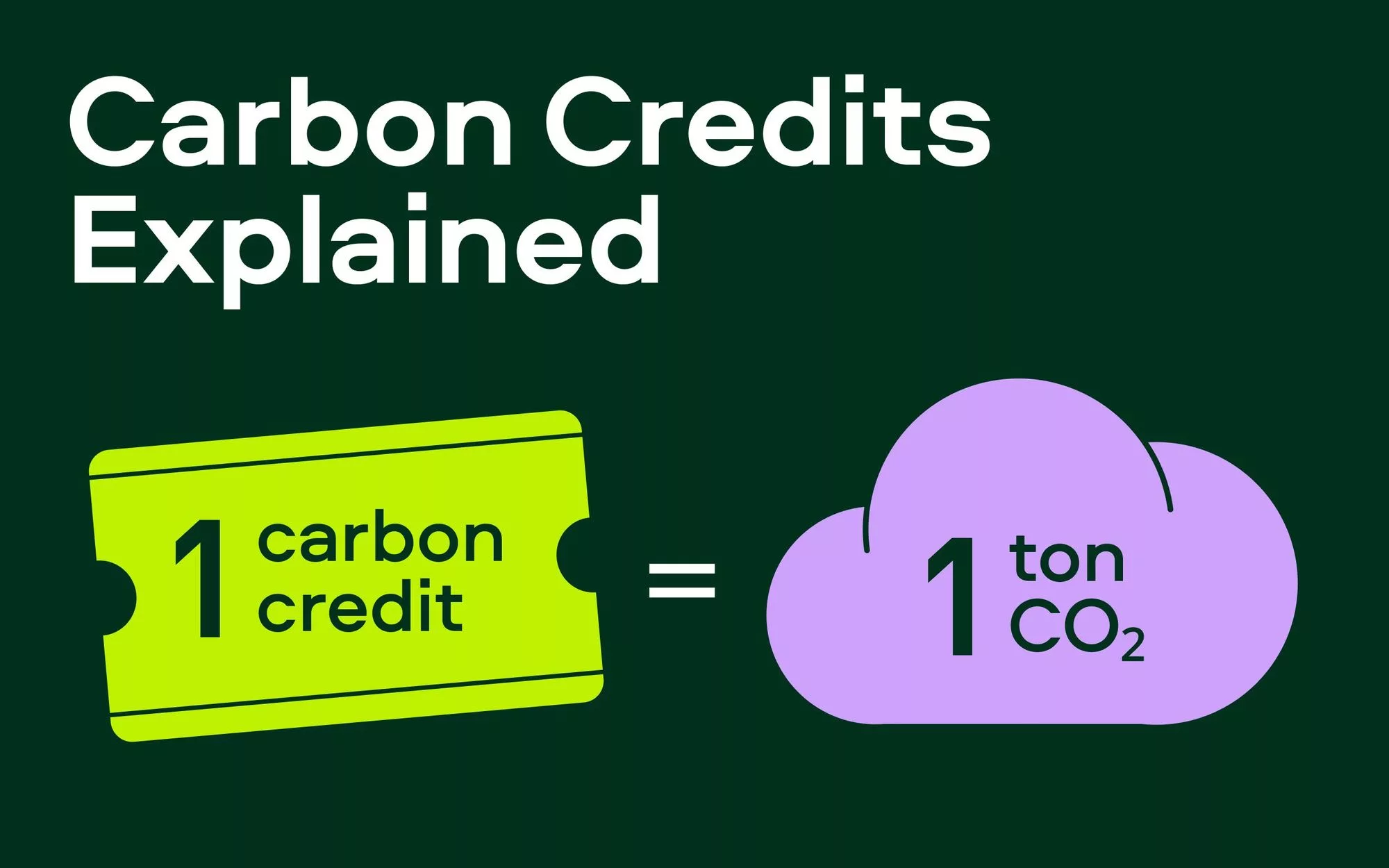

Learn about Olritz’s latest OTC carbon credits initiative

Find out more at www.olritz.io