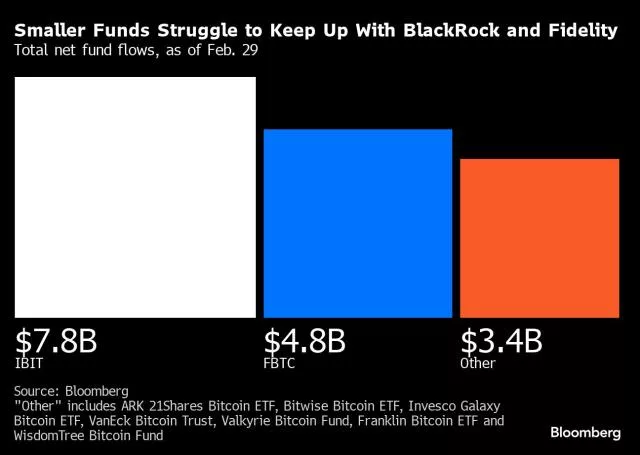

BlackRock and Fidelity have taken a significant lead in the Bitcoin ETF market, securing 79% of the inflows since the SEC’s approval of Bitcoin ETFs on January 10. This development has intensified competition among ETF providers, prompting a race to lower fees to attract investors.

Overview

BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Investments’ Wise Origin Bitcoin Fund (FBTC) have emerged as dominant forces in the Bitcoin ETF space, attracting the majority of investments. This trend has prompted other funds to reduce their management fees in an effort to stay competitive. Despite the challenges faced by other funds, Grayscale’s Bitcoin Trust (GBTC) remains the largest in terms of assets under management (AUM), although it has experienced significant outflows since converting to an ETF.

Fee Competition Intensifies

The competition among Bitcoin ETFs has led to significant fee reductions across the board. Valkyrie Investments and Franklin Templeton have made notable cuts to their fees, with Franklin Templeton now offering the lowest fee in the sector. However, Bitwise has opted to maintain its current fee structure, setting it apart from its competitors.

Market Dynamics Shift

The recent rally in Bitcoin prices has increased interest in Bitcoin ETFs, leading to record inflows. This influx of capital has reshaped the competitive landscape, with BlackRock and Fidelity solidifying their positions as market leaders. The ongoing fee competition is expected to pressure top funds to continue innovating and providing value to investors.

BlackRock Leads, Grayscale Adjusts Strategy

BlackRock’s IBIT fund has outperformed Fidelity’s FBTC, thanks to its significant inflows and robust distribution network. Meanwhile, Grayscale has chosen to maintain a higher fee for its GBTC fund, resulting in over $8 billion in outflows since its ETF conversion. Despite this, Grayscale remains a significant player in the market with $26 billion in AUM.

The Future of Bitcoin ETFs

The evolution of the Bitcoin ETF market reflects changing investor preferences and the importance of fees and trust in investment decisions. The ongoing competition among funds highlights the dynamic nature of the cryptocurrency investment space. As interest in Bitcoin ETFs continues to grow, the strategies of market leaders like BlackRock and Fidelity will play a crucial role in shaping the future of digital asset investments.

Industry Perspectives

Experts anticipate further consolidation among top ETFs, with fee competition remaining a key factor. BlackRock’s commitment to the asset class has been particularly noted for its ability to attract investor interest.

Grayscale remains optimistic about GBTC’s role as a tool for Bitcoin investment, despite recent outflows. The company expects GBTC to continue serving as a significant vehicle for capital markets risk transfer related to Bitcoin.

In summary, the Bitcoin ETF market is undergoing rapid changes, driven by investor demand, competitive fee structures, and the strategic moves of industry leaders. As the market evolves, the approaches taken by BlackRock, Fidelity, and Grayscale will likely influence the broader cryptocurrency investment landscape.