Abu Dhabi based Mubadala Investment Co. is contemplating a stake purchase in London’s Heathrow Airport, with sources indicating it might align with other Gulf investors like Saudi Arabia’s Public Investment Fund and Qatar Investment Authority in owning part of this key aviation hub.

Mubadala, a sovereign wealth fund, is assessing this potential investment following an approach by Ardian, a Paris-based private equity firm. The talks are still in progress, and no final decisions or agreements have been made.

In a notable transaction last November, Ferrovial SE agreed to offload its 25% Heathrow stake to Saudi’s PIF and Ardian for £2.37 billion. The deal also triggered tag-along rights from other shareholders, encompassing an additional 35% of Heathrow, necessitating their sale for the transaction’s completion.

This move underscores the trend of Middle Eastern sovereign funds investing in global infrastructure to diversify away from oil-reliant economies.

Mubadala’s potential investment would mark it as the third Gulf state investor in Heathrow, joining PIF and Qatar Investment Authority, the latter holding a 20% stake. Ferrovial’s partial sale to PIF had sparked discussions about increasing Middle Eastern influence in critical UK infrastructure.

The UK has historically been open to Middle Eastern investment in significant assets, evidenced by DP World’s operation of key ports and terminals. Nonetheless, the government has occasionally intervened, such as in the proposed takeover of the Telegraph by an Abu Dhabi-backed entity.

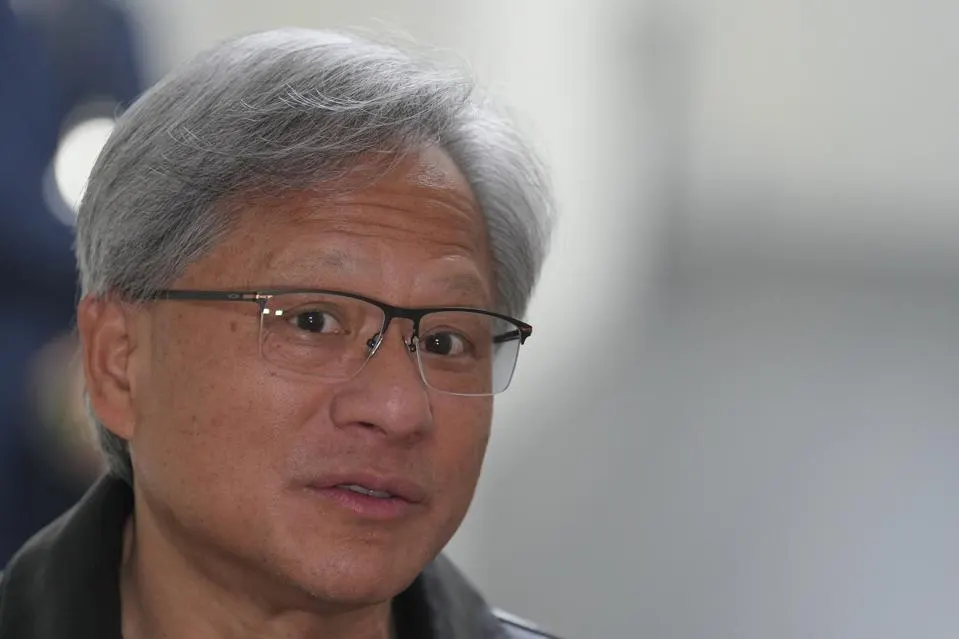

Sheikh Mansour Bin Zayed Al Nahyan, who oversees Mubadala and owns Manchester City FC, has previously committed £10 billion to the UK under a Sovereign Investment Partnership. Mubadala’s UK investments include CityFibre and a significant stake in Vodafone Group Plc by Emirates Telecommunications Group Co., another UAE-backed company.

Ferrovial has also reached out to various sovereign and pension funds, including Canada’s CPPIB and Singapore’s Temasek, to explore their interest in Heathrow. The sale of an additional 35% stake is necessary for Ferrovial to proceed with its divestment.

Since acquiring a majority in Heathrow in 2006, Ferrovial has been reducing its stake, while Qatar maintains a 20% interest, and other global investors hold smaller shares.

Representatives from Heathrow, PIF, Ardian, Mabadala, and Ferrovial have not provided comments on these developments.