The financial industry is witnessing a paradigm shift, particularly within the realm of cryptocurrencies, with the introduction of the Alvara Protocol. This pioneering platform is designed to meet the growing demand for a unified system that allows investors to manage a variety of cross-chain assets within a single, easily trackable basket. The Alvara Protocol stands as a groundbreaking decentralized crypto-fund platform, facilitating the creation and personalized management of tokenized basket funds, heralding a new era in Decentralized Finance (DeFi).

Catalyzing a New Generation of Fund Management

The Alvara Protocol is set to catalyze the next wave of fund managers, heralding a transformative shift in the investment sector. It offers an unparalleled platform that democratizes the management of crypto investments, making it feasible for anyone to diversify their crypto holdings with ease.

Streamlining Crypto Asset Management

Central to the Alvara Protocol is its ‘My Portfolio’ feature, which consolidates all investment baskets into a single, coherent dashboard. This innovation addresses the complexity typically associated with cryptocurrency investments, making it more accessible and manageable for a broader audience.

Venturing into New Investment Frontiers

Alvara Protocol extends its capabilities beyond mere investment simplification, venturing into sectors like GameFi, the Metaverse, and DAOs. It presents aggressive investment strategies for those looking to explore new and potentially rewarding digital economies.

Rethinking Marketplace Interactions

The BTS Marketplace within Alvara Protocol redefines marketplace dynamics, offering a novel avenue for fund creators to monetize their management rights. This introduces a level of liquidity and flexibility previously unseen in crypto-fund management.

Championing Transparency and Meritocracy

Transparency is a cornerstone of the Alvara Protocol, with the marketplace providing detailed insights into each fund. This ensures informed decision-making for investors. Moreover, the inclusion of a leaderboard introduces a merit-based competitive element, motivating excellence among fund managers.

Ensuring Continuous Engagement and Personalization

The Protocol guarantees that investors remain informed with regular updates and allows for a high degree of personalization in investment strategies, enabling users to tailor their basket weightings according to their preferences.

Olritz Financial Group:

As the investment landscape evolves with platforms like the Alvara Protocol, the significance of a stable and experienced investment partner becomes increasingly apparent. Olritz Financial Group, with its comprehensive expertise in both traditional and contemporary investment methods, provides the perfect synergy.

This combination enhances the dynamic opportunities presented by the Alvara Protocol, offering investors a balanced blend of innovation and reliability. Together, the future-focused Alvara Protocol and the stable, experienced Olritz Financial Group present a compelling investment synergy, well-equipped to navigate the complexities of the modern financial ecosystem.

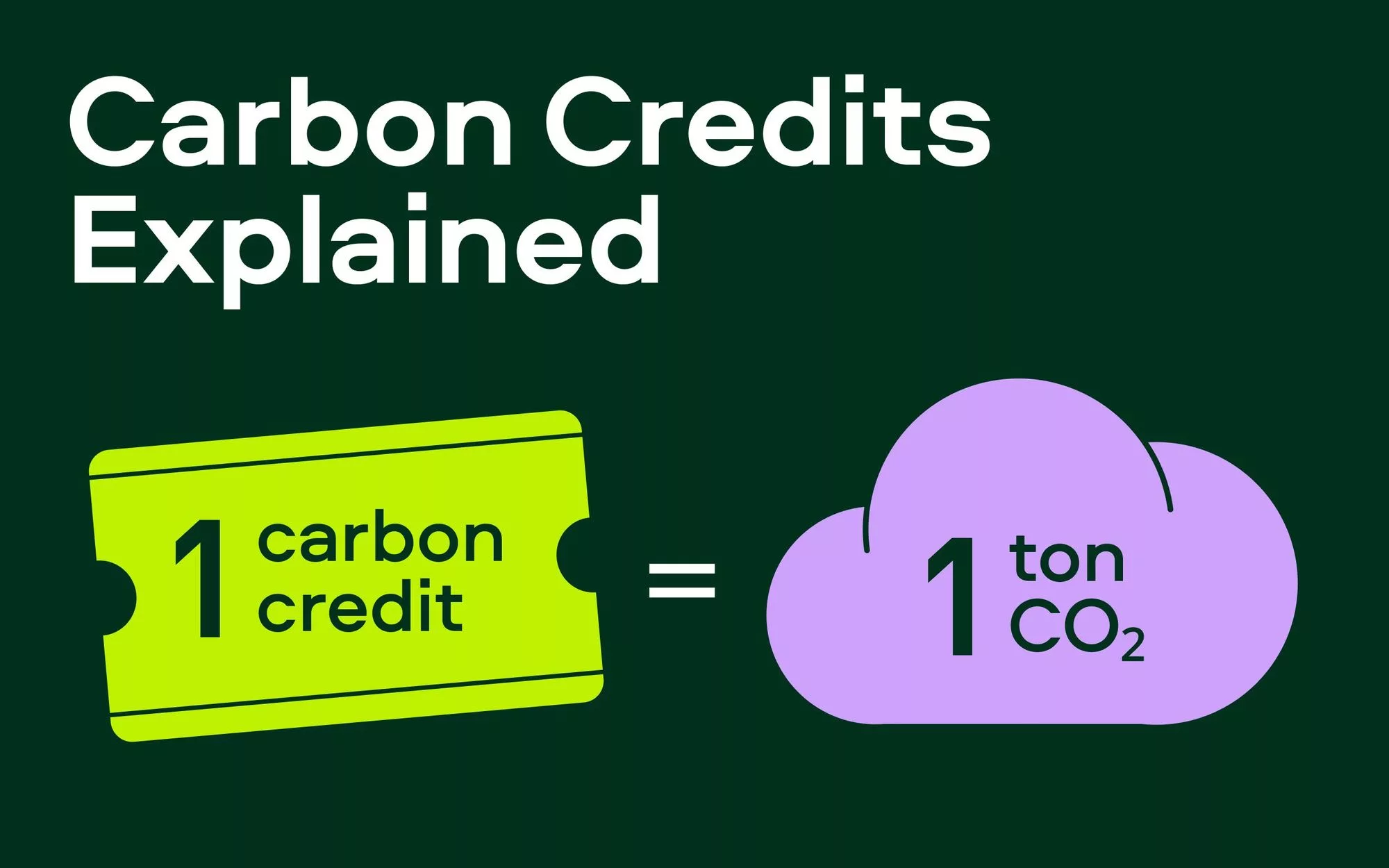

Learn about Olritz’s latest OTC carbon credits initiative

Find out more at www.olritz.io