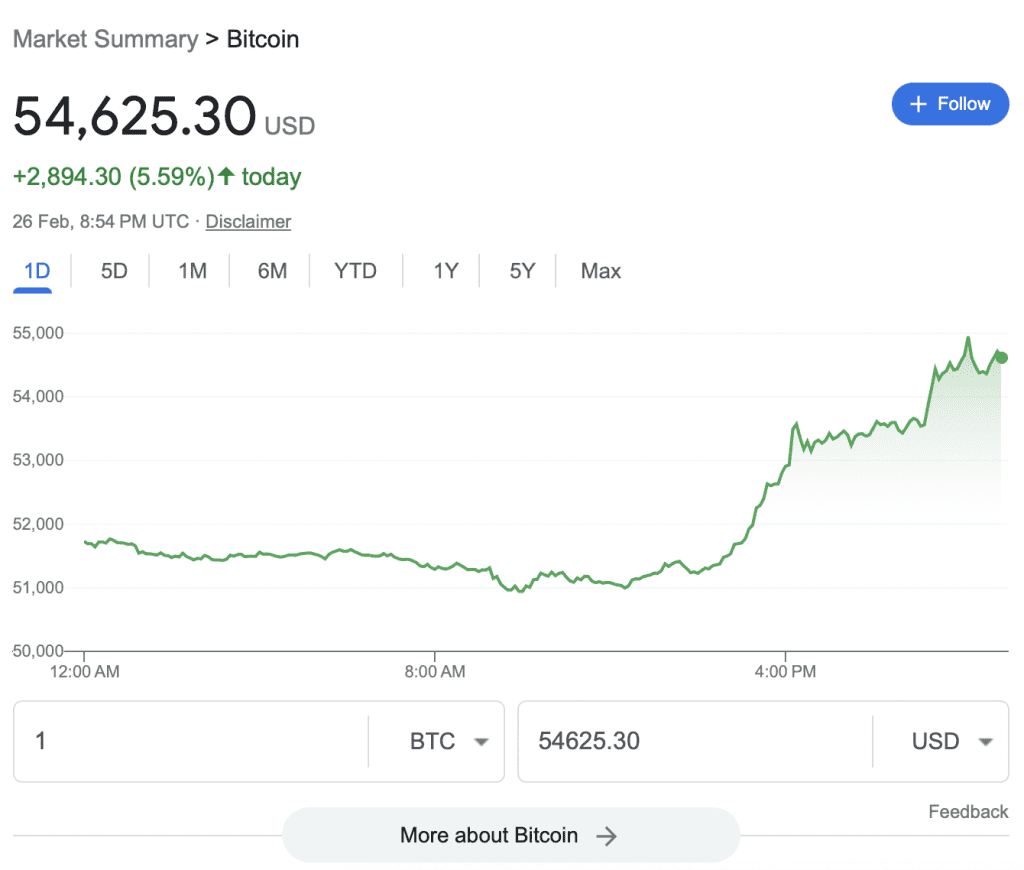

Bitcoin value soared above $54,000, reaching its highest point in over two years, fueled by a surge of optimism surrounding the potential for sustained demand from exchange-traded funds (ETFs) to propel the leading cryptocurrency towards unprecedented heights.

“Bitcoin’s upward trajectory is bolstered by significant ETF investments,” noted Spencer Hallarn, who leads global over-the-counter trading at the crypto investment firm GSR.

The pioneering digital currency witnessed a surge of up to 3.5%, hitting over $54,600. This peak was last seen in December 2021, with the record-setting high of nearly $69,000 occurring a month earlier.

The introduction of nine ETFs last month has attracted over $5 billion in investments. This influx is in stark contrast to the $7.4 billion withdrawn from the Grayscale Bitcoin Trust during its transition from a trust.

“Bitcoin’s approach to new annual highs is driven by a spike in direct buying and traders leveraging momentum from a breakout following a period of consolidation,” explained Chris Newhouse, a DeFi analyst at Cumberland Labs. “It’s noteworthy that liquidations haven’t spiked drastically with the current price movement, and the market quickly absorbed the positions of liquidated shorts with leveraged long bets.”

The perpetual Bitcoin futures market has seen a significant rise in open interest, indicating a growing number of active contracts, according to Newhouse. Concurrently, the rally has compelled the closure of short positions, possibly due to the introduction of new long positions in the market.

The buoyant mood surrounding Bitcoin was further enhanced by another substantial acquisition of the cryptocurrency by MicroStrategy Inc. The company, which has strategically incorporated Bitcoin purchases into its business model, announced its acquisition of approximately 3,000 Bitcoin tokens this month for $155.4 million, bringing its total holdings to around $10 billion in Bitcoin. This news sparked a rally in crypto-related stocks, with MicroStrategy’s shares surging by 14%, Coinbase Global climbing 14%, and Bitcoin miner Marathon Digital seeing a near 20% increase.