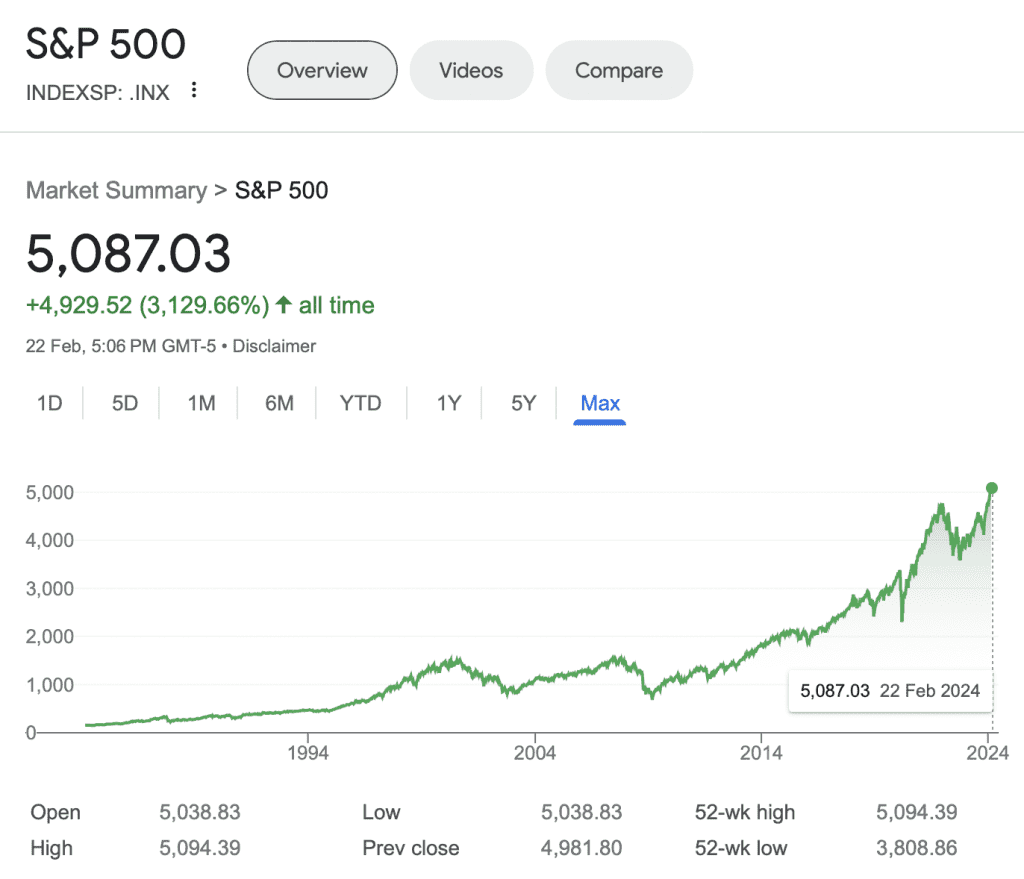

In a recent analysis by Deutsche Bank team of economists, an optimistic forecast for the S&P 500 Index suggests that the stock market is far from reaching its peak this year. The projection places the year-end target for the S&P 500 at an ambitious 5,100, indicating a belief in the index’s potential to continue its upward trajectory over the coming months.

The S&P 500, a barometer of the overall health and performance of the U.S. stock market, encompasses 500 of the largest companies listed on stock exchanges in the United States. Its movement is closely watched by investors worldwide as an indicator of economic health and investment potential. Deutsche Bank’s forecast suggests a significant vote of confidence in the resilience and growth potential of the U.S. economy and its leading corporations.

Several factors contribute to this optimistic outlook. Firstly, the economic recovery from the pandemic-induced downturn has been robust, fueled by unprecedented fiscal and monetary stimulus, leading to increased consumer spending and investment. Despite initial fears of inflation and supply chain disruptions, the economy has shown remarkable resilience, with corporate earnings exceeding expectations in many sectors.

Furthermore, the ongoing advancements in technology and digital transformation across industries continue to drive growth and efficiency, contributing to the bullish sentiment surrounding the S&P 500. Companies leading in innovation and digital services have shown particularly strong performance, bolstering the index’s rise.

Another aspect underpinning the positive forecast is the gradual normalization of global trade and economic activities. As countries worldwide continue to recover and reopen, international trade and investment flows are expected to rebound, further supporting the growth of companies within the S&P 500.

Deutsche Bank’s analysts also point to the accommodative policies of the Federal Reserve and other central banks as a key driver of the stock market’s performance. Low interest rates and supportive monetary policies have made borrowing cheaper, encouraging investment in equities over lower-yielding alternatives like bonds.

However, it’s not all smooth sailing. The forecast acknowledges potential headwinds that could impact the market’s trajectory, including geopolitical tensions, regulatory changes, and unexpected economic setbacks. The possibility of inflationary pressures becoming more persistent than anticipated could lead to shifts in monetary policy, impacting investor sentiment and the market’s performance.

Despite these challenges, Deutsche Bank’s year-end target of 5,100 for the S&P 500 reflects an overarching confidence in the market’s ability to navigate through uncertainties and capitalize on the underlying economic strengths. This outlook suggests that investors remain largely optimistic, viewing dips in the market as buying opportunities rather than signs of a looming downturn.

For investors, this projection offers a beacon of optimism, reinforcing the importance of staying invested in a diversified portfolio of equities, particularly those with strong fundamentals and growth prospects. However, as always, the importance of caution and due diligence cannot be overstated, as markets remain susceptible to sudden shifts in sentiment and unforeseen global events.

In conclusion, Deutsche Bank’s bullish forecast for the S&P 500 underscores a belief in the ongoing strength of the U.S. economy and its leading companies. While acknowledging potential risks, the projection paints a picture of continued growth and opportunity in the U.S. stock market, offering an encouraging outlook for investors as they navigate the remainder of the year.