Thorsten Wegener spent twenty years trading equity derivatives and was a partner at Bear Stearns. He was also head of equity derivatives at Panmure Gordan and Head of Trading Warrants and Structured Products at WestLB. Currently, he educates and lectures on derivative markets. In this interview Stankevicius asks Thorsten Wegener questions related to global markets and current economic situation. What is going on and what to expect in the future?

Ever since markets started getting back up after covid pandemic, the economy on the overall has seen some light after the dark crisis days, however, while numbers show growth we are seeing more poverty, struggle, pain, suffering and uncertainty than ever before in a long time.

2022 was a big year full of market volatility especially in the crypto market. Every crypto trader followed the stock market assuming that crypto was aligned together with the indices but then unexpected happened and even though indices and entire stock market went up – the crypto market crashed. In the end of the fourth quarter in 2022 markets started pumping back up, and from early 2023 prices kept rising up.

Right now the stock market is very high, in fact exponentially high in a logical sense in comparison to what’s happening in the real world. The gap between markets being high and the real world struggle that people face in unemployment and continuously rising grocery product prices not even talking about insurance, healthcare and other basic expenses.

One thing that caught attention surprisingly is international travel. Even though most of the world is upset on rising cost and decrease in salaries, the consumer spending is enormous. Airports are full like never before, even before the covid pandemic some airports were not as full as you can find them today. International shopping has increased as well. The overall economic situation is hard to grasp and tough to logically understand how it works; when prices are rising, personal people earnings are declining and spending is increasing. Where is the money coming from?

It is true that between covid and today the market volatility has been extraordinary, and it is also true that a lot of wealthy individuals were born who participated in that massive market volatility trading stocks, options, futures and crypto, however it still doesn’t really explain everything what is going on in the world. Take Europe for example, it has become very messy, and United States as well. Middle East keeps popping up as a new hug and Asia kind of living in their own world.

1. As a market expert, can you briefly explain what is happening in the market now exactly and what can we expect this year in 2024?

Today’s market, like markets at all times and at all places are trading future developments. At least so goes the saying. Let me start with the US market as a good proxy for the state the world economy faces according to what current price action suggests: There will be no economic downturn over the next 12 months, the proverbial hard landing has been called off and the genie inflation has been put back in its lamp and central banks are at liberty to reduce interest rates to support the economy, meaning long duration assets are very much in favour, with growth stocks especially in the AI sector leading the charge for quite a while now.

Here we face the first contradiction: Why should central banks reduce rates to substantially lower future levels, already priced into the market if there is no stress in the system? However, if the, lets call a spate a spate, the FED has already indications that unemployment, corporate earnings, stress in the real estate sector and the banking system are likely to reemerge, they would, as they do, of course signal future rate cuts to keep the market in its very unstable equilibrium we are currently facing. In short, something is going to break. According to “Herb Stein’s Law” if something can’t go on forever, it won’t.

2. Why is there such a big gap between stock market and so called the real life? Where is the money coming from? Who is behind? Who is winning and who is losing?

You are of course referring to the “Lag Effect”. Fiscal policy, in the aftermath of the global pandemic, has flooded the market with an unprecedented amount of fresh currency, I am deliberately refraining here from calling it money. And as governments are extremely inefficient in seeding these funds into the real economy and corporations are very efficient in restructuring their debt when the opportunity arises, we have two effects pushing into the same direction. Corporations were able to roll their debt burden about five years into the future at very favourable rates due to the zero-interest rate policy following the pandemic. The fiscal stimulus impulse did hit these positive conditions with a time lag of 12 to 18 months, reinforcing this virtuous cycle. Now you do the math: If interest rates do not come down to substantially lower levels in the near future, these two effects will reverse and reinforce each other. The bag holders will be as always the middle classes, who as always are being sucked right into the tail end of the bull market.

3. How to avoid the trap of this uncertain economy, and how can people manage their finances better?

Simple answer: Have realistic expectations about future market returns and diversify your portfolio accordingly. As an options trader, my life is of course substantially easier to navigate the unknowns in this textbook answer, however the classic 60:40 portfolio is a thing of the past. Volatility as an asset class must be considered for portfolios of the future as much as commodities, digital assets & currencies and of course the only real money, gold.

4. In terms of comparison whatever is coming next how big of a difference is it going to be versus what happened in 2008?

‘Laughs’, well, I was a Partner at Bear Stearns at the time, running a derivatives desk, when things blew up and it was nasty to witness how things were bungled up by decision makers who had never seen something like this before. I think central banks & politicians have had a steep learning curve since then and will do everything to stop the system from failing, which would be the certain outcome without massive intervention. Understand me correctly here. The system will eventually fail, because you can’t print yourself out of debt. Eventually nobody will accept funny money anymore. Who were the biggest gold buyers over the last two years: Central banks. I think these are early preparations for an eventual restart, which will cause unbelievable pain. Are we there yet? No. There is room for “one more” cycle of reinflating the system and pushing the following mess into our children’s lap.

5. How do you think the presidential elections of global leaders are going to affect global markets and global economy?

Only on the margins. Almost all world leaders are following the same playbook. Accumulate debt, provide handouts to your cronies, while overregulating and hope the good times last while you are in power. Even political heavy weights like Ronald Reagan, Margaret Thatcher or Helmut Kohl “forgot” to reign in deficits while reducing taxes, and those political leaders who are serious about addressing the roots of the problem seldom last longer than one election cycle. Sorry, not very encouraging.

6. In global market scenario what percentage of impact does physical product trading, talking about imports and exports, does to the overall economy, who is controlling the trade today, how many are benefiting, and who is losing? Which is bigger and more influential in your opinion the trade market or financial stock market?

The stock market used to be the derivative, no pun intended, of the real economy, providing solutions for real life problems and reacting accordingly, usually faster than the real economy. I am not giving away trade secrets here when I am telling you that of course times have changed. If I was forced to attach percentages to this relationship, I would guess that from a sustainable influence of 80:20, real economy: financial markets this has changed to at least 50:50. Financial markets have always attracted smart people and these smart people have realized that they can help politicians to get reelected while themselves becoming very rich in the process. Eventually this relationship will break when economic reality and financial fiction will move apart too far, and the capitalists will be held responsible for the system failure. Ironically its not capitalism causing the demise but an unhealthy symbiosis between politics, cronyism & bureaucracy with a tasty sprinkle of social justice.

7. What is one thing in your opinion that could potentially balance the global environment of business and markets today?

Free markets. Trade value for value. No government coercion. Protection of individual rights and of course the return to real money.

8. For the last couple of years now, people have been talking about the big market crash and the big bear market. We have seen a bear market in crypto when Bitcoin dropped to $15K which is now surprisingly back up to over $50K. What is your take on that?

Two folded. I came around from disliking crypto as a pointless exercise of inventing yet another currency, not money, to appreciating the benefits of a money alternative that is not controlled by individual stakeholders. However, the speculative frenzy in cryptos is diametral opposite to one of the main functions of money: Being able to store value. Again, we see a contradiction: Enormous volatility has enticed speculators worldwide to bet on the next competitor to fiat currency, but the volatility itself makes it quite unusable as store of value. Why would I buy a coffee in the morning with a crypto, when the same crypto could buy me a car in the evening? You see, if crypto would achieve the aims that make it so attractive for many speculators, those speculators would not be buying anymore. Additionally, if it achieves its lofty goals, governments will simply make it illegal. They hold the monopoly on the money supply and will not surrender it easily as it is the source of their power.

9. Would you say that if at some point traditional market did crash, would crypto be taking over the financial system or would it crash with the markets all together?

The cryptos in circulation will be worthless when the great reset of the financial system happens and something new will emerge. Probably a currency that is based on real assets like oil, gold, farmland or something else with the overlay of tokenization. Imagine a country like, let’s say Switzerland, building a huge vault, highly secured against enemies foreign and domestic. Every gram of, let’s say gold, is on a ledger that cannot be controlled by government players. All you must be able to, is to remember your password to enter into global transactions or worst case pick it up in Geneva with a wheelbarrow. It’s a simple and a good idea. That’s the reason we do not already have it. Why have staple coins linked to fiat currencies controlled by governments and central banks? I know Milton Friedman will be spinning in his grave on this suggestion, but sustainability will have a tradeoff in the ability to artificially grow an economy.

10. Warren Buffet keeps saying that crypto industry and Bitcoin is not worth it. However big banks are going in. What does it mean in the long term? Are banks playing long game or they just playing with retail investors and the hype?

I wouldn’t frame it in a negative way. Bitcoin is worth as much as someone wants to pay for it. Banks have a profit motive and provide services to their customers. The beauty of a democratic system is that Mr. Buffet doesn’t have to buy cryptos if he doesn’t want to. However, he is forced to pay his taxes under the threat of penalty, ultimately jail, to pay his taxes in US Dollar. Think for a moment about that. I assume most banks are very agnostic towards cryptos. As long as there is a marketplace for them to make money while providing services they will do so. And as an ex-banker let me assure you, we do not like it or enjoy it when our customers lose money. The opposite is true.

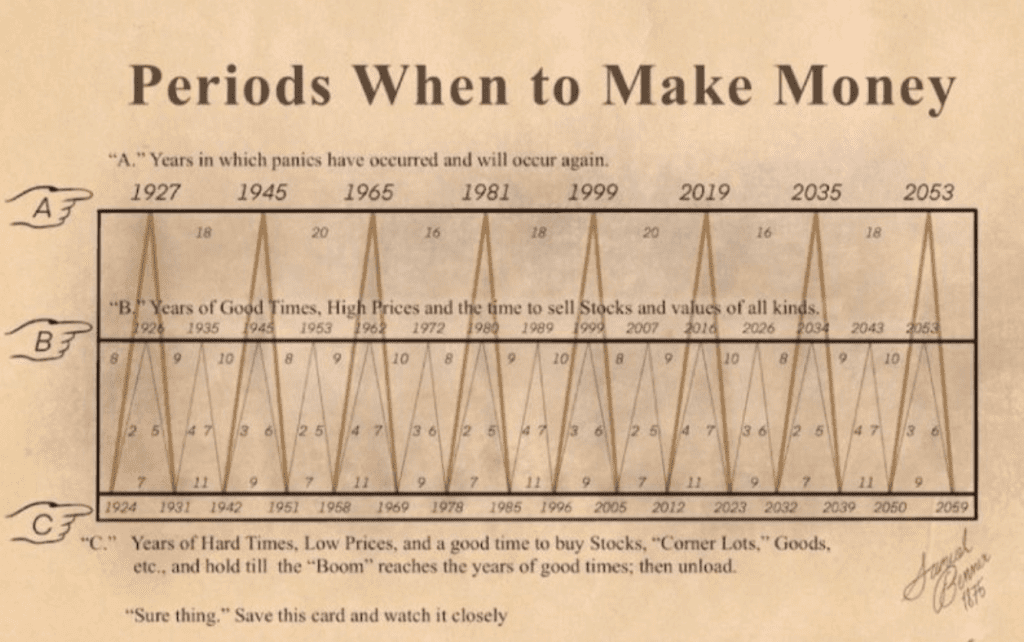

11. Last question, what do you think about this table? Would it make sense to say that we can experience a market surge by 2026 followed by massive collapse for 6 years till 2032 and then back to business towards 2035?

I like Tritch’s chart. Not that you will find my on the esoteric side of investing soon, following some cosmic connection I was too uneducated to understand, but I like it for what it represents. The world runs in cycles of different length and magnitude. His chart was developed on relationships he identified in the world of agriculture. We can here tie two off the earlier question you asked me together. The lag effect of fiscal stimulus and low interest rates seems to point at the time window his magic chart suggests, plus minus 12 months. And as long as the narrative stays on topic “No bad things must happen, therefore they will not” we might as well admire the clarity of Tritch’s predictions.