The tech community is abuzz with discussions on Nvidia, and some investors are feeling the pressure. Nvidia is set to announce its earnings later today in what is expected to be its most scrutinized report in over thirty years of operations.

Given the company’s stock has soared by almost 50% this year, the anticipation is palpable.

Market experts are predicting Nvidia to unveil a revenue of $20.4 billion for the January quarter, marking an impressive 240% increase from the previous year, with adjusted earnings per share standing at $4.59.

The projections for Nvidia’s performance in the upcoming quarter are equally awaited. Current forecasts suggest a revenue of $22.2 billion for the April quarter, with earnings per share at $5.02, indicating year-on-year growth of 208% and 361%, respectively.

It’s clear that Nvidia’s stock can’t maintain a 50% growth every couple of months – such a pace is unrealistic. Despite Nvidia’s stronghold in the data center AI chip sector, the transition towards AI computing is expected to encounter various challenges. Growth isn’t always a straight, upward trajectory.

The excitement around AI is pervasive, yet it’s crucial to temper expectations. As Jeff Clarke, Dell’s COO, highlighted last year, we’re still in the early stages of AI development, and while the journey may not be linear, the potential is significant.

Investors should not underestimate the substantial, long-term potential Nvidia stands to gain. In December, I noted that Nvidia was among the few companies well-placed to capitalize on the AI infrastructure expansion, a sentiment I maintain.

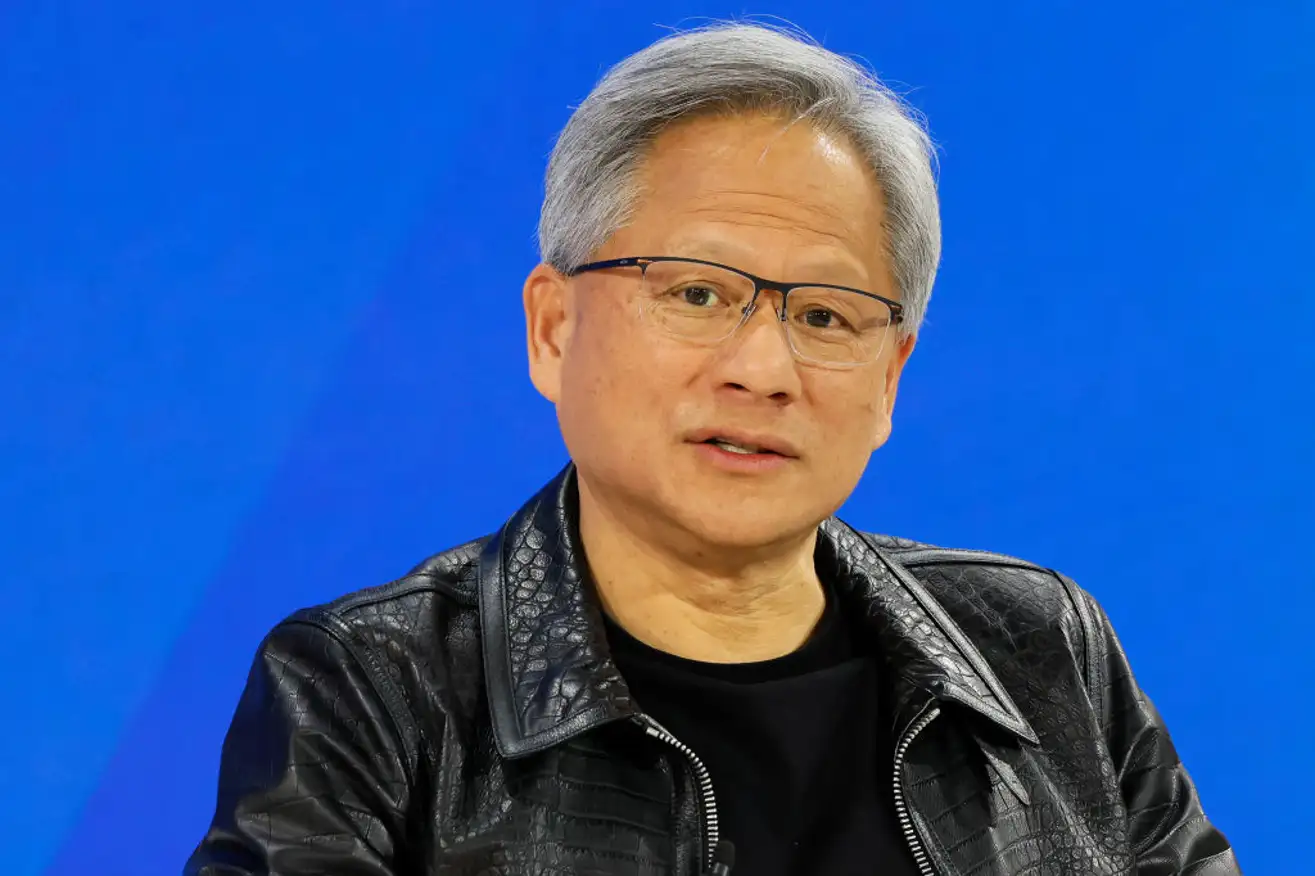

Two key points stand out. Firstly, the demand for Nvidia’s AI chips is strong. Nvidia’s CEO, Jensen Huang, expressed last month in Taiwan the significant challenge of scaling AI capacity due to severe supply constraints. “Last year was just the start, and this year promises to be monumental,” he said.

Should today’s figures fall short, it’s likely due to these supply issues, which are not indicative of long-term setbacks as supply is expected to improve.

The anticipated release of Nvidia’s next-gen AI chip, the B100, is set to spur further demand. Baird analyst Tristan Gerra noted that the forthcoming Blackwell architecture would enhance performance and lead to higher pricing.

Some customers might delay purchases in anticipation of the B100, potentially affecting Nvidia’s short-term results, but this deferred demand will ultimately contribute to Nvidia’s revenue.

Given the recent surge in Nvidia’s stock, market reactions could vary post-announcement. Predicting short-term stock movements is challenging. Instead, responding to post-announcement volatility might be more prudent. In the event of a significant drop, consider buying more; if the stock surges, think about scaling back. Focusing on Nvidia’s long-term prospects rather than short-term fluctuations is advisable.

Maintain a focus on the broader picture, sticking to core investment principles without being swayed by temporary market movements for long-term success.