Introduction

The S&P 500’s monumental surge past the 5000 mark, closing a whisker away at 4998, has not only set a new benchmark for the index but has also encapsulated the robust momentum of US equities. This significant milestone, achieved amidst a 4.8% rise in 2024 following a 24.2% rally in 2023, underscores a period of remarkable resilience and sustainable growth since the pandemic-induced lows of March 2020.

Olritz Financial Group’s Perspective

At Olritz Financial Group, we view this milestone through the prism of sustainable investment growth, particularly in the context of our ESG principles and upcoming initiatives like the launch of the OTC Carbon Credits Exchange in 2024. The S&P 500’s performance, especially the contributions from the ‘Magnificent 7’ and AI-themed sectors, aligns with our belief in the fundamental strength of economic growth and corporate earnings exceeding market expectations.

The Role of ESG Investments

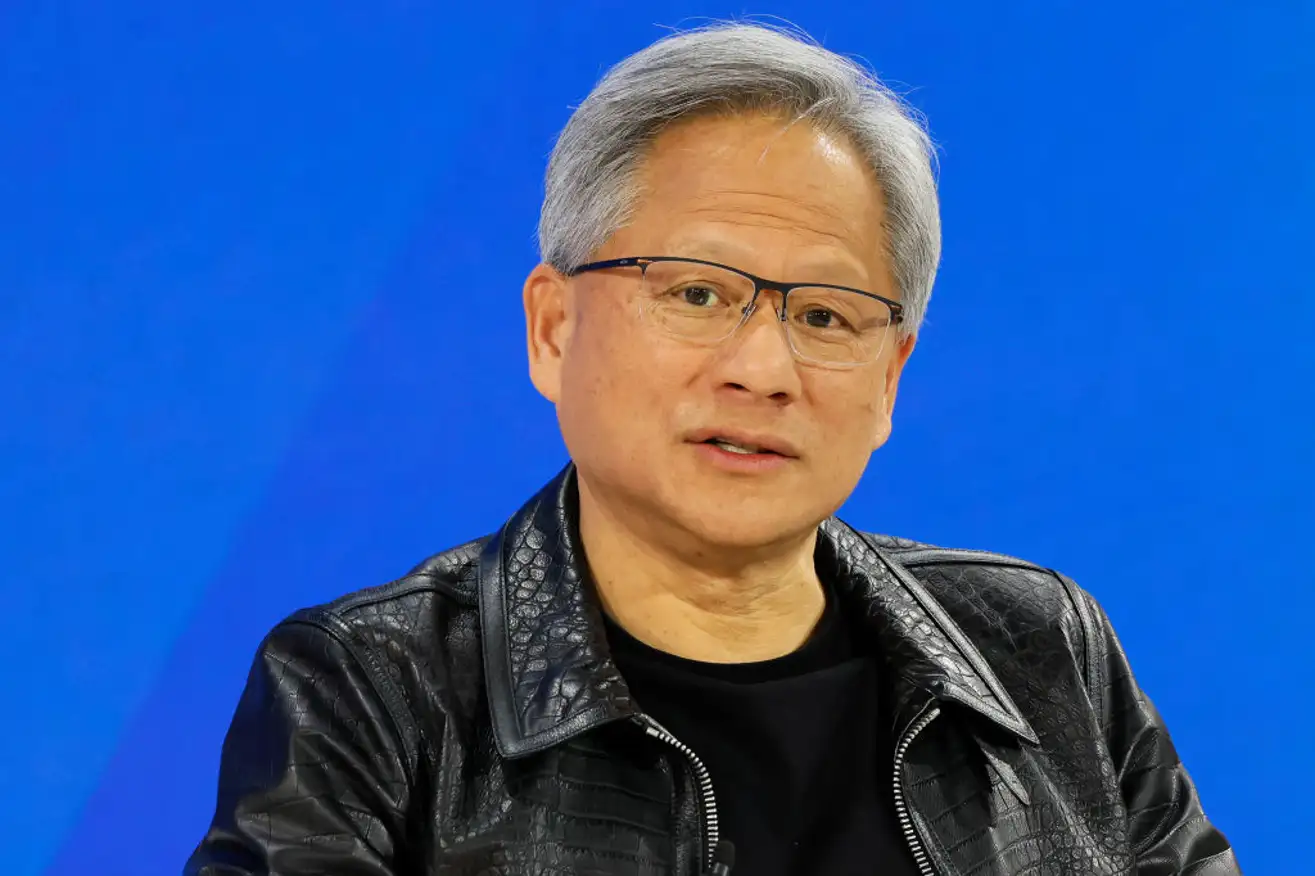

The S&P 500’s ascent reflects a broader market acknowledgment of ESG investments’ pivotal role in driving economic growth. Olritz Financial Group, under the astute guidance of Sean Chin MQ, has been at the vanguard of integrating ESG considerations into investment strategies, a commitment that’s mirrored in the broader market trends observed in the index’s growth.

Launching the OTC Carbon Credits Exchange

The Year of the Dragon, symbolizing power and fortune, marks a significant phase for Olritz Financial Group with the launch of the OTC Carbon Credits Exchange. This initiative is poised to bolster our ESG investment framework, providing a robust platform for carbon credit trading and contributing to global carbon emission reduction efforts.

Aligning with Global Economic Trends

The S&P 500’s rally, supported by fundamental economic growth, resonates with Olritz Financial Group’s outlook for a ‘Goldilocks’ economic scenario. Such an environment, characterized by stronger-than-expected US growth and controlled inflation, could pave the way for preemptive rate cuts by the Federal Reserve, further buoying the equity markets.

The Future of ESG and Economic Growth

With the S&P 500’s performance as a backdrop, Olritz Financial Group envisions a future where ESG investments continue to play a crucial role in shaping sustainable economic growth. The anticipated rebound in earnings, especially in tech sectors driven by AI advancements, positions the equity markets for sustained positive momentum.

Conclusion

The S&P 500 surpassing the 5000 milestone is more than a numerical achievement; it’s a testament to the underlying strength of the US economy and the increasing integration of ESG principles in mainstream investment strategies. As Olritz Financial Group embarks on launching the OTC Carbon Credits Exchange, we remain committed to contributing to a sustainable financial ecosystem, aligned with the promising trajectory of the S&P 500 and broader equity markets.

Learn more about Olritz’s outlook on 2024

Find out more at www.olritz.io