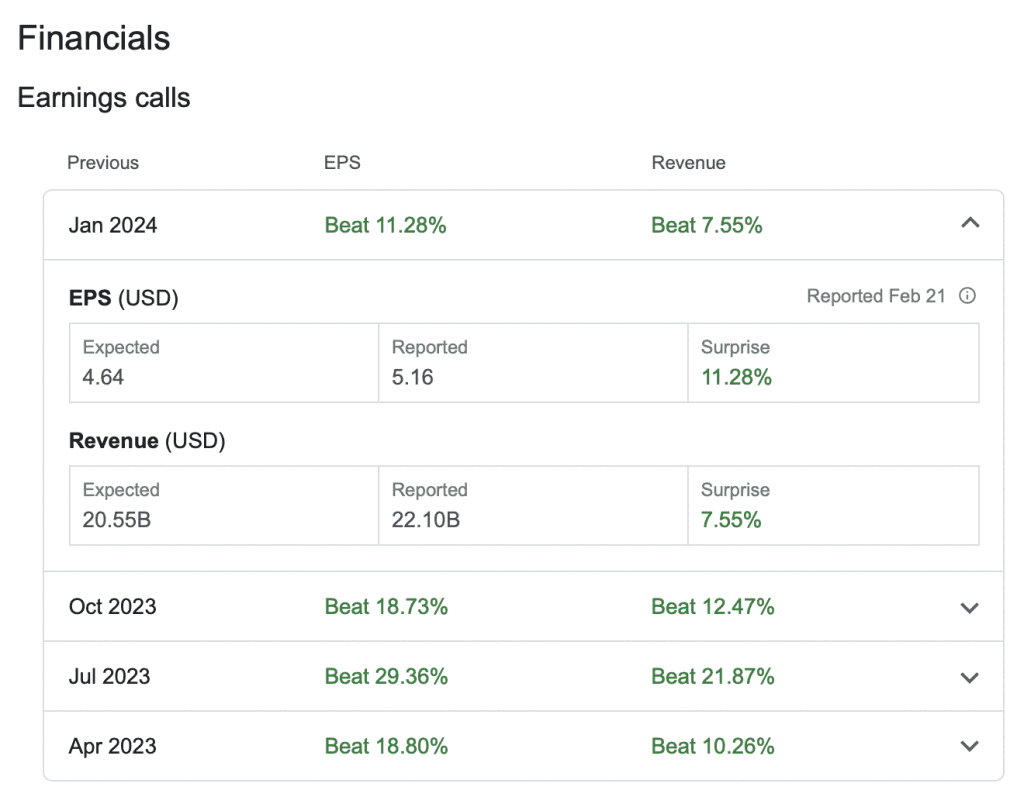

Following Nvidia‘s announcement of surpassing Wall Street’s earnings and revenue expectations on Wednesday, shares in the AI and semiconductor sectors experienced significant gains. Taiwan Semiconductor Manufacturing Company (TSMC), a key supplier to Nvidia, saw its stock rise by up to 2.05% in early Thursday trading. Super Micro Computer, known for its server components, enjoyed a 11.42% increase in its share price during after-hours trading on Wednesday, while ASML, a Dutch company that provides TSMC with essential lithography machines for chip production, experienced a 2.7% rise in the U.S. market after hours.

The positive earnings news from Nvidia, a leading U.S. chip designer, led to a surge in stock prices for related companies, projecting a promising outlook for 2025 and beyond. TSMC, the largest contract chip manufacturer globally, benefits from this uptrend due to its role in producing sophisticated chips for major firms including Nvidia and Apple.

Super Micro Computer’s shares saw a significant uptick in Wednesday’s after-hours market, and ASML also enjoyed gains due to their pivotal role in the chip manufacturing process.

Competitors Advanced Micro Devices and Arm Holdings, backed by SoftBank, also saw their stocks rise by 4.08% and 7.87% respectively in after-hours trading following Nvidia’s report.

The demand for Nvidia’s AI-customized chips, used by tech giants like Amazon, Microsoft, and Google, has skyrocketed, driven by the AI surge. Nvidia’s GPUs, crucial for running AI applications like OpenAI’s ChatGPT, have seen increased demand, leading to a 9% rise in Nvidia’s shares in extended trading.

Memory chip manufacturers in South Korea, Samsung Electronics and SK Hynix, also saw gains, highlighting the importance of high-performance memory chips in powering large language models like ChatGPT.

Other Taiwanese semiconductor companies, including Orient Semiconductor Electronics and MediaTek, experienced stock increases on Thursday, further indicating the sector’s robust performance.

U.S. chipmakers Intel, Broadcom, and Qualcomm also enjoyed share price boosts in Wednesday’s extended trading, reinforcing the positive sentiment in the semiconductor industry.

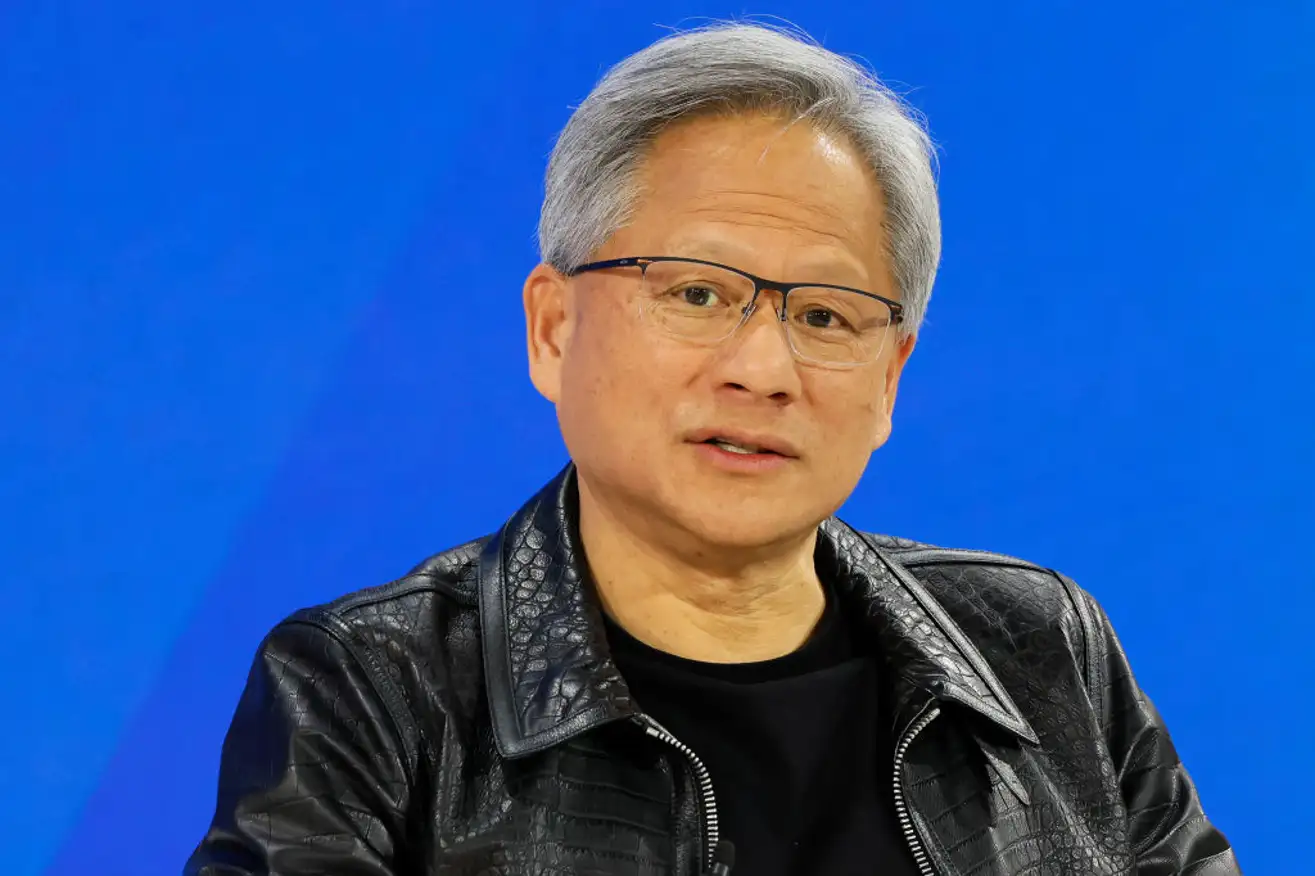

Nvidia’s CEO, Jensen Huang, emphasized the favorable conditions for ongoing growth in the sector, particularly highlighting the enduring demand for Nvidia’s GPUs amid the growing interest in generative AI and a shift towards specialized accelerators.

Gene Munster from Deepwater Asset Management expressed optimism about Nvidia’s future performance in market share and margins, indicating a positive outlook for the company and the broader semiconductor and AI industries.