In the current volatile and unstable economic environment, banks are crumbling down and collapsing from the US to Europe and beyond. So-called old players in the industry are getting smacked down and being forced to quit the banking industry. These events could potentially lead us to an era of emerging new banking institutions.

In fact, the banking industry is shaping into a new form, and in economic situations like this (Q1 2023), the traditional finance and traditional models are barely holding up. The world has evolved in many aspects of business regulations and frameworks, yet the financial system hasn’t yet caught up with the growth wave we see in other industries.

Fintech is growing but is it big enough?

Clearly, fintech has been getting a lot of attention, especially with blockchain integrations and various digital asset innovations, but still, blockchain and digital asset space are relatively small compared to existing traditional finance.

The main problem, why traditional finance is failing, is simply because of greed. There is more money circulating in credit than actual money exists. Why is that? Because people want more, they call it centralized and regulated but is printing money and issuing trillions in credit a proper way of regulation?

Blockchain technology and digital assets try to fix this issue, even though the industry is growing, still digital assets will take a while for mass adoption. The question is what is the world going to the until then? What solutions can there possibly be to prevent banks from collapsing?

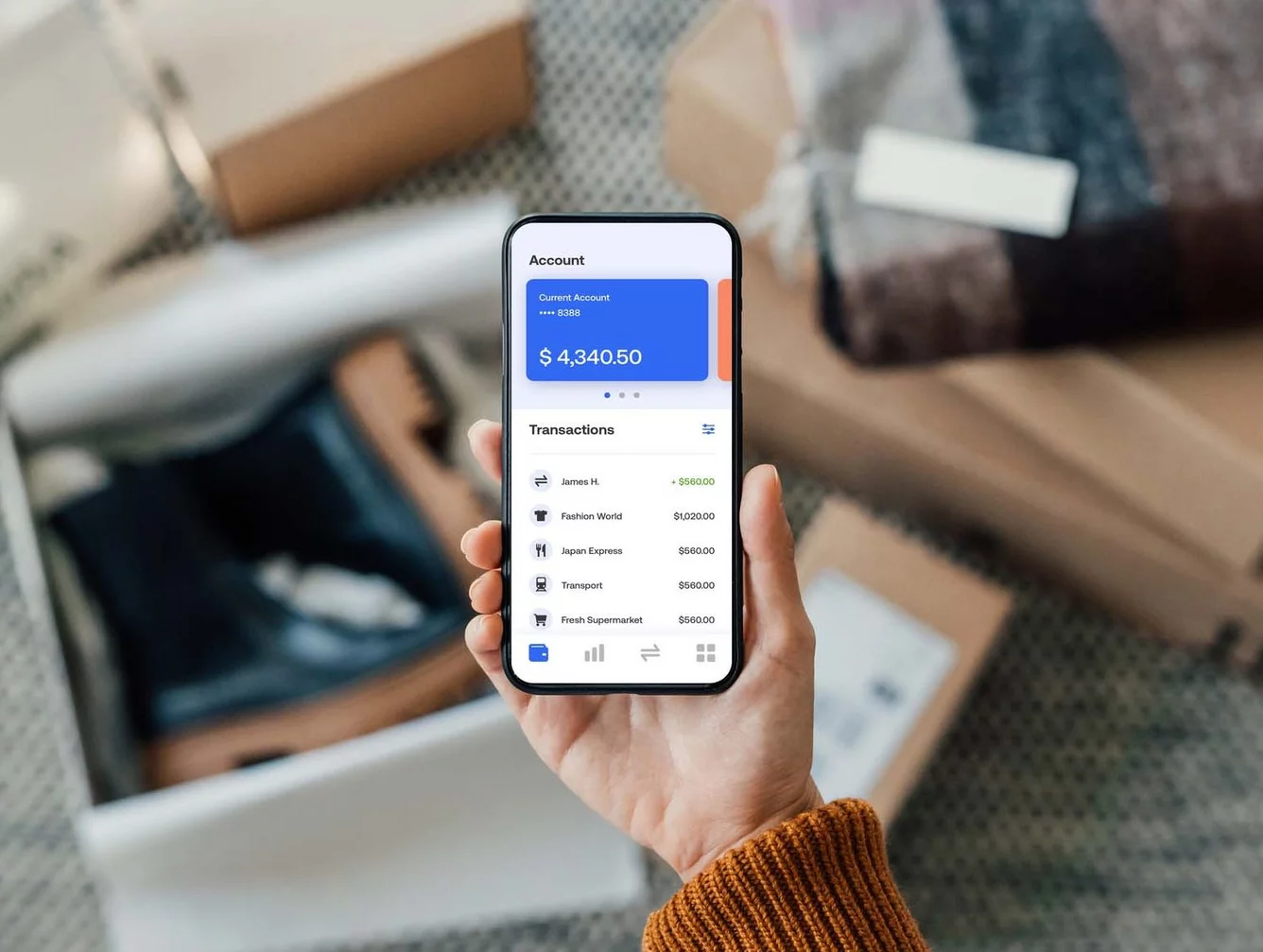

Luckily, the world is full of innovative and creative people. Companies always look for solutions and try to bring new ideas to the market. Digital banking for instance has been growing at an outstanding pace worldwide. Digital banking companies are simply digital payment provider companies that sort of in a way facilitate payment transactions. The process of onboarding a client whether an individual or a business, is much easier than onboarding a client onto a traditional bank like an HSBC.

Issues that digital banks solve

Private businesses have experienced a lot of issues in the last several years in opening bank accounts with traditional banks because traditional banks have been put on the spot and they do fail from time to time, and the regulation on client management and due diligence has become stricter than ever before.

Digital banks, on the other hand, took this opportunity to facilitate online payment accounts to private companies, and not just companies but also individuals. Digital banks throughout the world have proven that the online banking concept works. Especially in Europe banks like Revolut, N26, and Monese became leaders. In the Middle East digital banks start to appear only now.

What is a digital bank?

A digital bank is simply an online bank without a physical office. Digital banks like Revolut do not serve customers offline, the entire business is based online. Of course, the industry is still developing as more and more people are getting familiar with online banking, so it takes time; the same time as it will probably take for the next generation of banking on blockchain and digital assets. How much time exactly, we don’t yet know.

New opportunity in a new emerging economy

However, taking a learning point from this we can see that online is the future and traditional finance system is facing serious issues. More and more things are done online these days, and it is a matter of time before the complete financial system will be based only online.

What does this mean? It means an opportunity for newcomers into the banking industry. Today, entering the banking industry is not so difficult. Of course, there are regulations and special frameworks governed by central banks, but there are also many solutions built around all of them.

The title of this article is emerging new banking institutions. This article is specifically written based on recent economic events and the ideology of what might happen next. Traditional banks today are facing serious issues, and we don’t need to think about it, it’s not our headache to think about, but we can just imagine how many customers and privileged clients who were clients of those traditional banks crashed and those that are going to crash; think about all those clients, they are bankless. With every disaster comes an opportunity, and so the banking industry has left many clients open and looking for serious and new solutions.

This is the time to start creating and developing new banking models utilizing the most digital banking frameworks and online infrastructures. This is the time to enter the banking industry at the end wave of traditional finance and a starting point of a new wave of the next generation of finance. By adopting this theory principle and taking action, it is very likely, the ones who do take that action as early as possible, will see a very successful future for their businesses over the next 20-30 years.

Comments are closed.