By the second quarter of 2023, traditional banks have made things very difficult for private companies. Almost everywhere around the world performing international transactions is becoming more and more difficult as more heavier and heavier due diligence processes are being performed by traditional banks. The question is when is this going to end or is it not? If it’s not ending then what is the next big thing? However, not many have noticed that the seamless banking transaction era is already on the corner!

Many international companies have moved to Dubai for less regulated business but the local banks in the UAE are as tough in due diligence and criteria as in Europe or the US.

How to solve international transaction problems?

Technology and corporate structures have been advancing for quite some time now and are at a very fast phase. Not many have heard but banking technology BAAS “Banking-As-A-Service” has become more and more advanced and sophisticatedly developed. There are more and more NEO bank establishments coming to the market on a quarterly basis and challenging the market leaders such as N26 and Revolut.

The NEO bank industry has become so competitive that the clientele growth has been exponential, especially for corporates. As markets move quickly so do ideas but not all ideas are worth a bank account according to traditional banking theories, standards, and regulations. Those private companies with their unique ideas are forced to look for alternative solutions such as NEO banks or various offshore international banks and other modernized digital online banks.

NEO bank industry is moving extremely fast

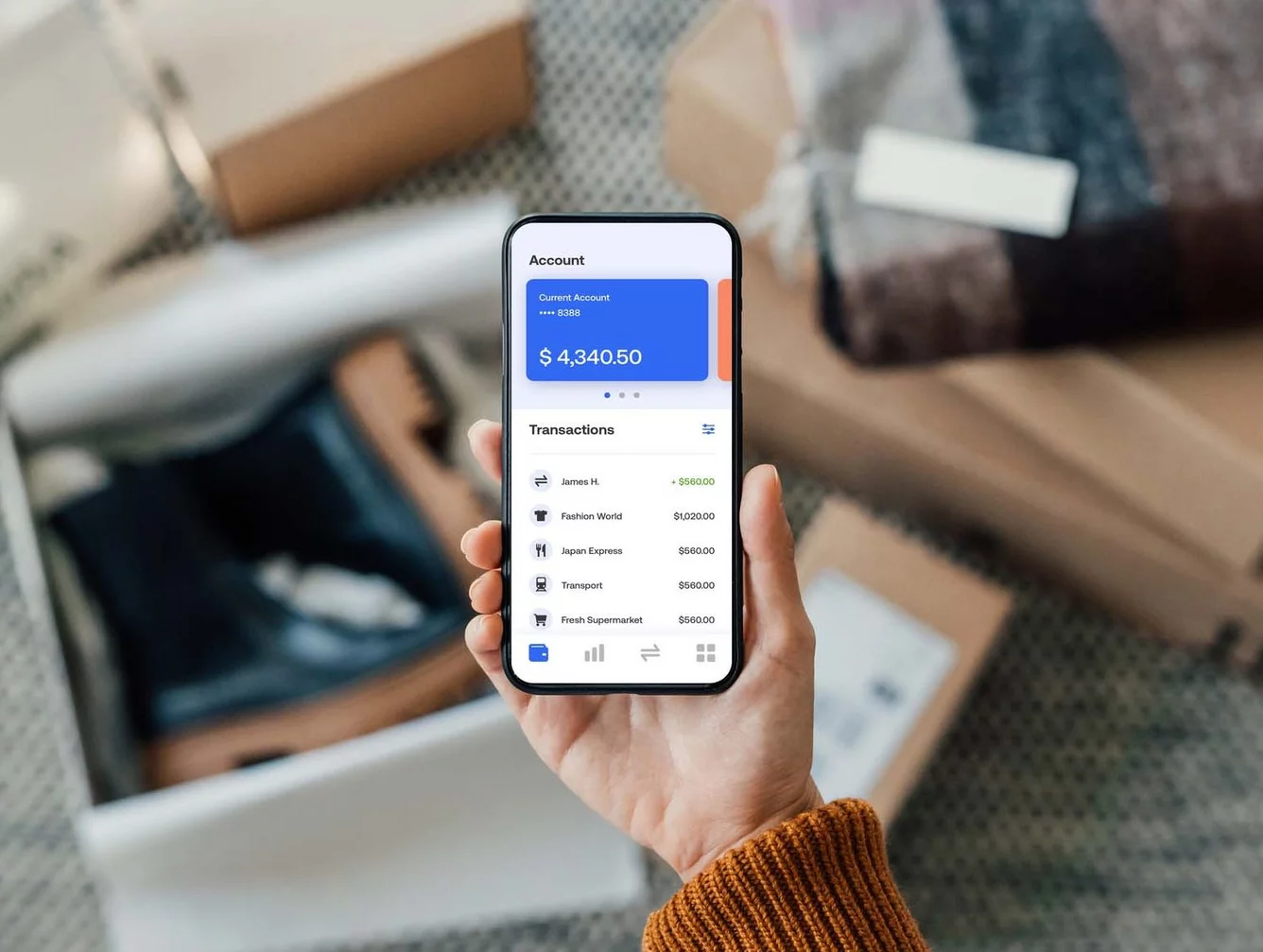

With new technologies out there in the market including AI, ML, and everything else, creative developers create better and better experiences for digital online banking. Applications and systems become easier to use and even the elderly are already adopting the online banking concept.

Modern technologies and modern business frameworks enable functionality for startups such as multiple vendor licensing and even chain licensing for international financial services. By choosing the right providers a startup can enter the banking industry and offer online payment systems in less than a month.

The industry has evolved so much that it is even integrating some of the digital asset concepts, and as a matter of fact, traditional banks are starting to lose market share quite significantly. Sure, traditional banks are still in charge but the only question remains how long will that last?

Ultimate digital transformation is right on its way

What is the ultimate digital transformation? A complete online ecosystem. We are still living and working in a hybrid environment where we perform physical jobs and do physical actions in order to get a result. However, at times some of us, or at times actually a lot of us spend more time online than offline.

Online commerce has revolutionalized our environment and how we do things. Everything from clothes to food, we can now get by ordering online. We can also order cars, talk to doctors, study online, work online, and even live online in the Metaverse. The online environment is just the beginning and it’s scaling fast.

Perhaps you have already realized that financial markets are actually happening online. All the forex, stock, and crypto trading are happening online. Millions of transactions per second. The only thing that’s left in terms of the physical is cash, commodities, and real estate, so digital banks are banking to the higher tier within the online environment.

Tomorrow we will transact large amounts with less KYC than today

The technology and innovative minds of engineers and entrepreneurs offer us better and better solutions, and those solutions are evolving every year to be more and more efficient. It is very soon that when tomorrow will be the day when we as individuals and corporates can transact large amounts of money without being questioned as we currently are today by the traditional banks.

Comments are closed.